An Analysis Using the Competitive Forces Model of an Industry Can Indicate:

The Porter Five Forces analysis model first appeared in a Harvard Business organisation School professor Michael E Porter published in Harvard Business organization Review in 1979. The publication of this paper has historically inverse the understanding of strategy among enterprises, organizations, and even countries. Information technology was named one of the ten most influential papers of Harvard Business organization Review since its inception.

A Five Forces analysis tin help companies appraise industry attractiveness, how trends will touch on industry contest, which industries a company should compete in—and how companies can position themselves for success.

Five Forces Assay is a strategic tool designed to give a global overview, rather than a detailed business organisation analysis technique. It helps review the strengths of a market position, based on five key forces. Thus, Five Forces works all-time when looking at an entire market sector, rather than your ain business and a few competitors.

What is the V Forces Model?

The master idea of this model is that the key to an enterprise obtaining a competitive advantage lies in the profitability (industry attraction) of the industry in which the enterprise is located and the relative competitive position of the enterprise in the industry. Therefore, the primary task of strategic management is to select potentially highly profitable industries by analyzing v factors including suppliers, buyers, current competitors, alternative products, and potential entrants. After selecting industries, enterprises should choose 1 of three strategies, such equally low-cost, production dissimilation or centralization, every bit their competitive strategy, based on their strength and the comparison of the five forces.

Porter's 5-force analysis model has a global and profound touch on on corporate strategy formulation. Applying it to the analysis of competitive strategy can finer clarify the customer'southward competitive environment. Its application range from the initial manufacturing industry gradually covers about all industries such equally financial services, high engineering and so on.

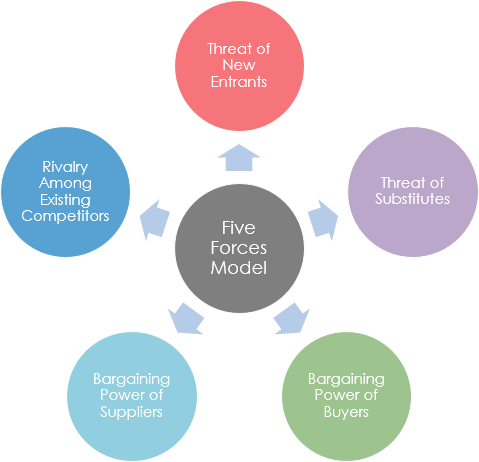

The Porter Five Forces model brings together a large number of different factors in a simple model to analyze the basic competitive landscape of an industry. The Potter 5 Forces model identified five main sources of competition, namely:

- Bargaining power of suppliers

- Bargaining power of Buyers

- Threats of New Entrants

- Threats of Substitutes

- Competition of existing competitors in the industry

(A) The bargaining power of suppliers

When the input elements provided by the supplier constitute a large proportion of the total cost of the production to the buyer, the potential bargaining power of the supplier is greatly increased. In full general, suppliers who meet the following atmospheric condition will have stronger bargaining power.

- The supply-side industry is for some companies that take a relatively stable market position and are not plagued by vehement contest in the market.

- Supply-side products have certain characteristics, buyers are hard to convert, or conversion costs are too high

- The supplier facilitates forrad integration, or otherwise impose an boosted cost to the production process

(B) The bargaining power of buyers

Buyers mainly influence the profitability of existing companies in the manufacture through their ability to lower prices and requirements to provide higher product or service quality. In general, buyers who meet the following weather have strong bargaining power:

The total number of buyers is small, and each heir-apparent purchases a large amount and accounts for a large percentage of the seller's sales

The seller'south manufacture consists of a large number of relatively pocket-size companies

The purchaser purchases a standardized production, and it is economically feasible to purchase the product from multiple vendors at the same time.

Suppliers facilitate forward integration, while buyers find it difficult to combine or integrate backward.

(C) Threats of new entrants

New entrants, while bringing new production chapters and new resources to the industry, hope to win a place in the market place that has already been divided past existing companies. This may crusade competition with existing companies in raw materials and market share, resulting in the existing industry. The level of corporate profits is reduced, even threatening survival.

The severity of competitive entry threats depends on two factors: the size of the barriers to entry into new areas and the expected response of existing businesses to entrants.

Barriers to entry mainly include the following factors:

- Economies of scale

With the expansion of business organization scale, the industrial characteristics of the decline in unit of measurement product costs, the higher the industry's everyman effective scale, the greater the barriers to entry. - Differentiation caste

Differentiation refers to the unique targeting of products and services to customer needs. The higher the difference, the greater the barrier to entry. - Conversion price

The conversion cost of a customer or buyer refers to the extra price that the customer must pay to alter the supplier. - Technical obstacles

Includes patented technology, proprietary applied science, and learning curve. - Command of sales channels

The company's self-built distribution channels, good partnerships, and reputation, brands, etc. - Policy and Constabulary

National policies protect sure industries, such equally the financial manufacture.

(D) Threats of Substitutes

Two companies in different industries may generate competing products considering of the products they produce are alternative products.

- Increased selling price and profitability of existing products will be limited due to the beingness of alternatives that can exist easily accepted by users.

- Due to the intrusion of alternatives, existing companies must improve product quality or reduce costs.

- The intensity of contest from producers of alternative products is affected by the cost of the conversion of product buyers.

(E) Competition amongst existing competitors in the manufacture

Enterprises in most industries are closely linked to each other's interests. As part of their overall strategy, their goal is to brand their own companies more than competitive than their competitors. There are conflicts and confrontations, oftentimes manifested in prices, ad, product introductions, and afterwards-sales services.

Features of the Porter Five Forces Tool

Porter Five Forces provides tools for in-depth analysis of the visitor's industry, helping companies empathise the competitive environment, correctly grasp the five competitive forces facing the company and formulate a strategy that is beneficial to the company'southward competitive position. In full general, the Potter Five Forces model has the following characteristics:

- Competition-oriented

- Studying existing industries

- Pay attention to the turn a profit potential of the industry

How to apply the Five Forces Model?

Porter's five-strength analysis model is a powerful tool for companies to conduct environmental assay, specially industry analysis, but information technology is not all of the visitor's strategy. Enterprise applies Porter's v-force model besides needs to be balanced both internally and externally.

- Based on Porter'southward five forces analysis, the degree of matching of its resources with the manufacture is examined. Under the conditions of intensified marketplace competition, whatever enterprise has certain risks in entering unfamiliar areas. Whether to seize these opportunities, enterprises must consider their cadre capabilities and advantages.

- Based on Porter's five forces analysis model, information technology examines market trends and the degree of strategic flexibility. At that place is no immutable market place, and there is no strategy in one case and for all. Strategy formulation is a dynamic process of constant feedback and constant adjustment. It is necessary to maintain a certain degree of strategic flexibility.

- Even if there is a adept strategy, it needs good strategic landing capability. The role of people in current enterprises is becoming more and more important. Inspiring people has become the nigh important gene in the sustainable development of enterprises, how to design a fix of effective and diversified incentive mechanism system is particularly of import for employees at different levels.

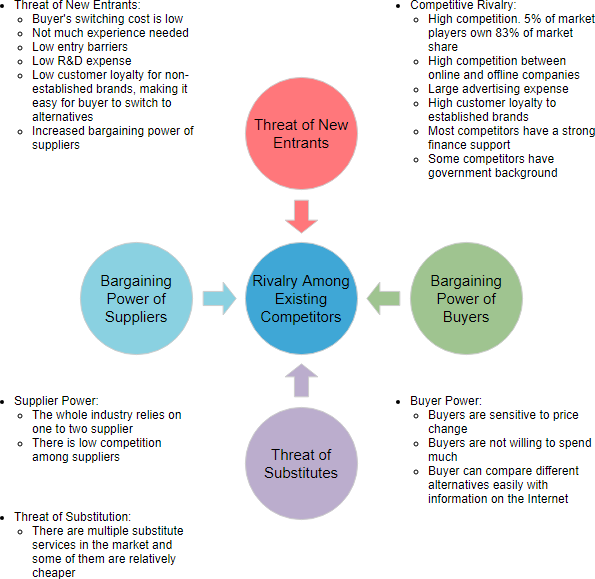

5 Forces Analysis Live Example

The Five Forces are the Threat of new market place players, the threat of substitute products, ability of customers, power of suppliers, industry rivalry which determines the competitive intensity and attractiveness of a market place.

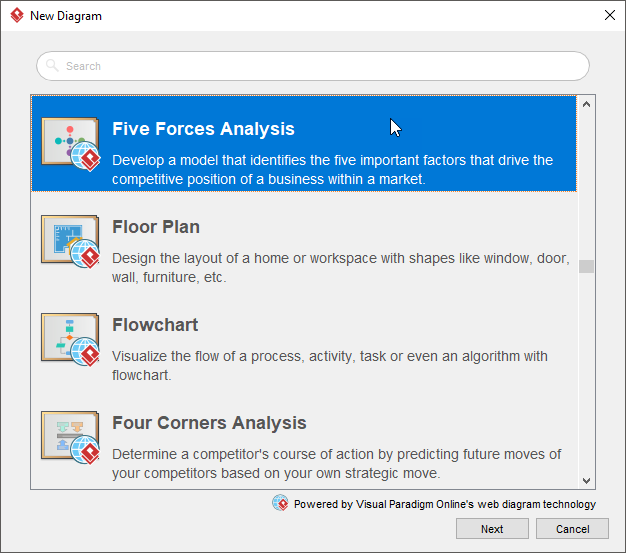

Performing Five Forces Analysis in Visual Epitome

Allow's encounter how to perform the V Forces Analysis in Visual Paradigm. We will employ a uncomplicated Five Forces Assay instance here. You may expand the example when finished this tutorial.

- Select Diagram > New from the main menu.

- In the New Diagram window, select Five Forces Analysis and click Next.

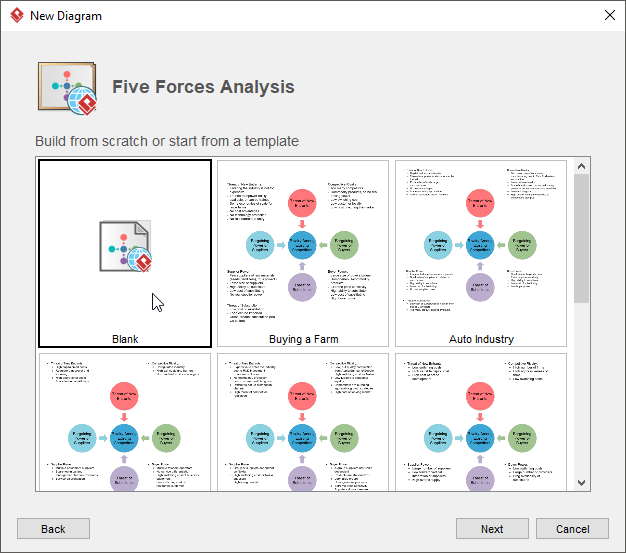

- Yous tin can start from an empty diagram or beginning from a Five Forces Analysis template or 5 Forces Analysis example provided. Let's start with a bare diagram. Select Bare and click Next.

- Enter the proper name of the Five Forces Analysis model and click OK.

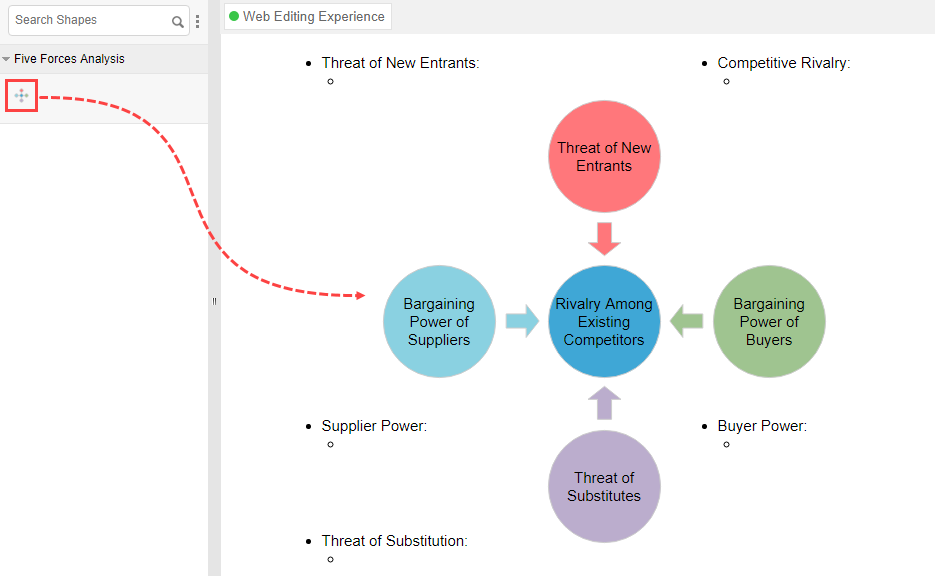

- Drag the 5 Forces Assay shape from the diagram toolbar and drop it onto the diagram.

- The editing of the Five Forces Analysis model is done via the InfoArt shape. Click on the V Forces Analysis shape to evidence the InfoArt shape.

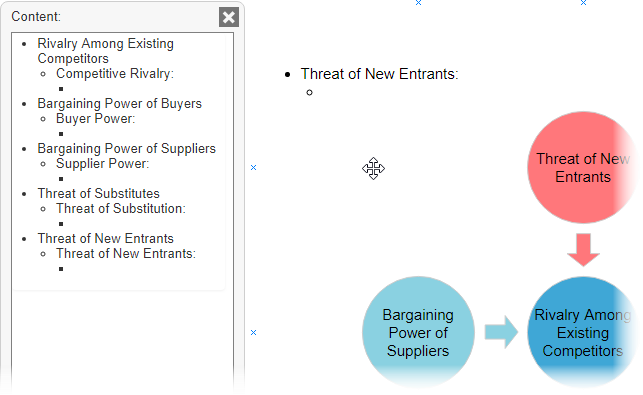

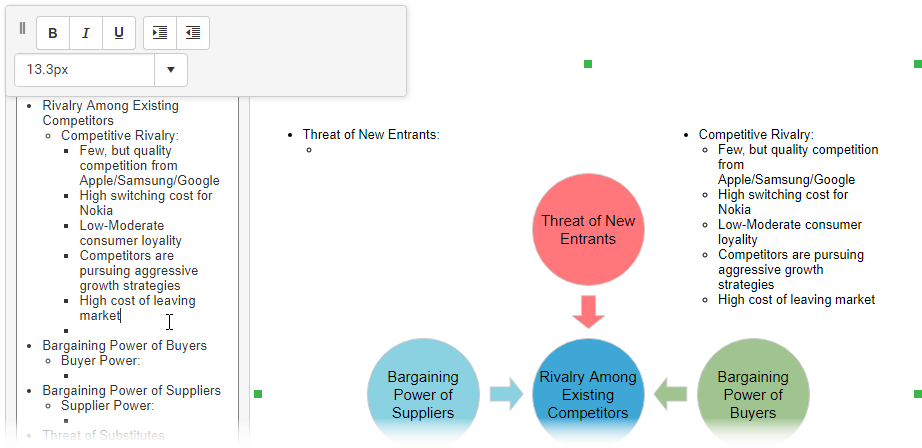

- Start entering the content in InfoArt.

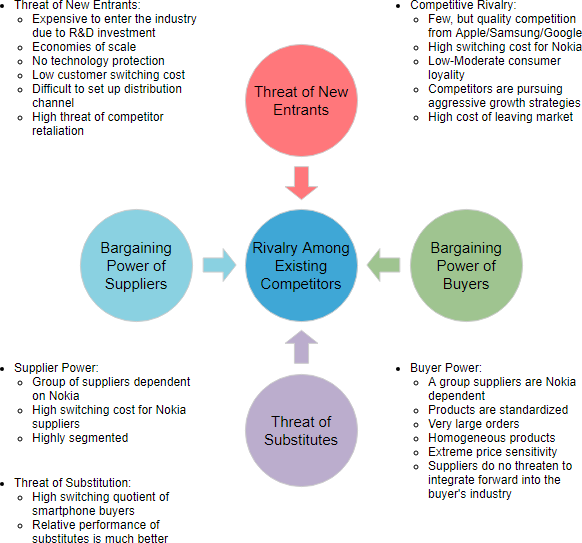

This is the final Five Forces Assay:

Source: https://www.visual-paradigm.com/tutorials/five-forces-analysis-tutorial/

0 Response to "An Analysis Using the Competitive Forces Model of an Industry Can Indicate:"

Postar um comentário